NEWS RELEASE

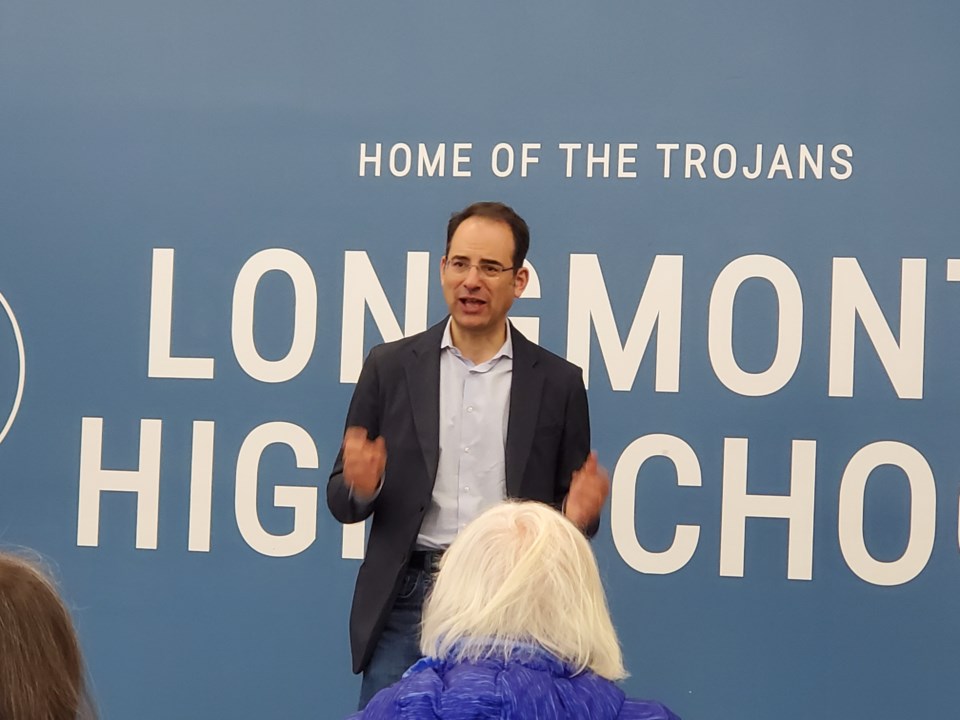

ATTORNEY GENERAL PHIL WEISER

*****************************

DENVER - After a yearlong investigation, Colorado Attorney General Phil Weiser today filed a lawsuit in Denver District Court to block the $24.6 billion proposed merger between Kroger and Albertsons, two of the largest supermarket chains in Colorado. Kroger operates 148 King Soopers and City Market stores and Albertsons operates 105 Safeway and Albertsons stores in the state.

According to the lawsuit, the merger would eliminate head-to-head competition between Kroger and Albertsons and consolidate an already heavily concentrated market, which is bad for Colorado shoppers, workers, and suppliers. The lawsuit also challenges an illegal “no-poach” agreement between the two companies during a 2022 strike when employee movement was a threat to Kroger’s operations.

“Coloradans are concerned about undue consolidation and its harmful impacts on consumers, workers, and suppliers,” stated Weiser. “After 19 town halls across the state, I am convinced that Coloradans think this merger between the two supermarket chains would lead to stores closing, higher prices, fewer jobs, worse customer service, and less resilient supply chains.”

Head-to-head competition eliminated

Kroger and Albertsons compete head-to-head in several ways. For example, the companies monitor each other closely on price and adjust their prices based on what the other one is doing. A post-merger Kroger would have the ability to raise prices, pinching consumers. In urban areas, where consumers shop close to home, the consolidation of Kroger and Albertsons stores would create significant market power to raise prices and reduce quality and services. Consumers in other areas of the state would feel the effects even more. For instance, City Market and Safeway are the only supermarkets in Gunnison. The merger would make Kroger the only supermarket in this area, and a Gunnison resident would have to drive 65 miles to Salida or Montrose to reach a non-Kroger store, leaving them at the peril of their supply chain failing.

Kroger and Albertsons also compete for customers in part by offering strong customer service and a quality shopping experience. The King Soopers strike that lasted for 10 days in January 2022 is an example of this competition between the stores. Investigation documents show that consumers overwhelmingly diverted their shopping to Safeway stores during the strike.

The strike also shows that Kroger and Albertsons compete for employees. King Soopers was concerned about losing employees and customers to Safeway during the strike and entered into an agreement with Albertsons whereby Safeway agreed to not hire any King Soopers employees and to not solicit any of King Soopers’ pharmacy customers, according to an email between company executives leading up to the strike. Such no-poach and non-solicitation agreements are illegal under the Colorado State Antitrust Act because they are agreements to not compete.

“In addition to challenging this merger, we are also suing the two companies for a no-poach agreement that harmed workers and blatantly violated antitrust law. No-poach agreements stifle worker mobility and depress wages and non-solicitation agreements harm consumers and raise prices,” explained Weiser.

Kroger and Albertsons also compete to offer the best local products to draw customers into their stores. For example, Kroger and Albertsons often sell Palisade peaches on promotion—and sometimes at a loss—to generate store traffic. This benefits Palisade peach farmers because they can be assured of a fair price and avenues to sell their crops, and it benefits consumers because they have access to great local product at low prices. The same dynamic plays out for other local Colorado products, ranging from produce and other fresh products like meat, dairy, baked goods, or center-store packaged products.

The merger would eliminate this head-to-head competition between the companies.

Divestiture proposal is inadequate

In an attempt to lessen the anticompetitive impacts of the merger, Kroger has presented a proposal to sell off 413 stores and other assets nationwide to C&S Wholesale Grocers, a privately held wholesale supplier that currently operates 23 stores, none of which is in Colorado. As part of the divestiture plan, C&S would acquire 50 Safeway stores and both Albertsons stores located in Colorado, which would be re-bannered into Albertsons stores. Under the plan, a total of 53 Safeway stores would transfer to Kroger, bringing its Colorado store count to 201.

The proposal is inadequate because it would not alleviate the anticompetitive effects of the merger, echoing many of the problems that have plagued failed grocery divestitures in the past. First, C&S has insufficient retail grocery experience to take on a divestiture of this size. Second, there are not enough stores to allow C&S to effectively compete with Kroger post-merger the way that Albertsons does today. Third, a transition agreement makes C&S reliant on Kroger for up to two years for pricing, pharmacy, promotions, loyalty programs, and IT infrastructure, diminishing competition between the companies.

Weiser asserts that the Kroger divestiture plan must be viewed with heavy skepticism in light of Albertsons’ involvement in a failed divestiture plan when it merged with Safeway in 2015. As part of that merger, the Federal Trade Commission ordered Albertsons to divest 168 stores, almost all of which were sold to Haggen, a small regional grocer that operated 18 stores in Washington and Oregon. Shortly after acquiring the divested stores, Haggen filed a lawsuit accusing Albertsons of anticompetitive conduct and violating the FTC’s divestiture order. Haggen went bankrupt within months of the divestiture sale, Albertsons bought back many of the stores at a steep discount, and many other stores closed.

“Our conclusion in this case—and our skepticism about the proposed divestiture—is strongly supported by what happened in the Albertsons/Safeway merger, where stores closed, jobs were lost, consumers suffered, and the divestiture failed miserably to preserve competition,” stated Weiser. “We won’t risk another such failed divestiture and we will fight hard to preserve competition for consumers, workers, and suppliers, all of whom have raised serious concerns about the remedy proposed in this case.”

The attorney general’s lawsuit asks the court to find that the merger violates Colorado antitrust laws and to permanently block it from going into effect. The lawsuit also seeks $1 million in civil penalties from Kroger and Albertsons each for entering into the illegal no-poach and non-solicitation agreement during the 2022 King Soopers strike, and to bar the companies from enforcing or entering into such agreements.

As part of the merger review process, Weiser held 19 listening sessions across the state in 2023 to hear directly from Coloradans and their feedback about the merger. The attorney general’s office also received more than 6,100 responses to an online survey about the merger. The information gathered helped ensure that Coloradans had a voice in process.

*****************************