While half of millennials now own their homes nationwide, still less than half of those in the Denver Metro — which includes Boulder County — can call themselves homeowners.

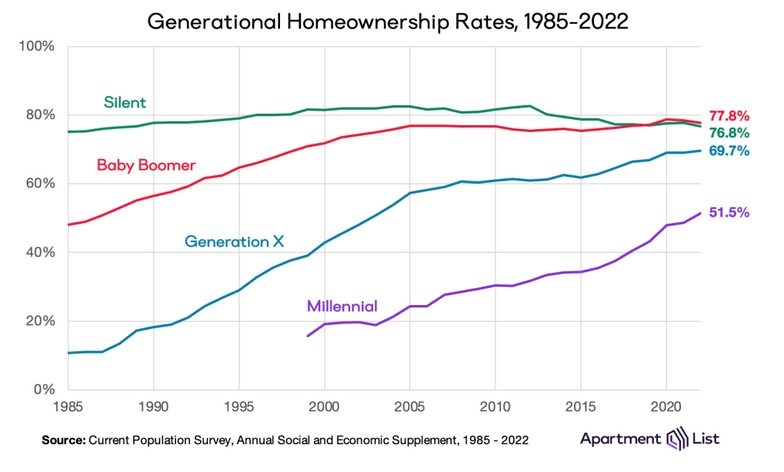

According to an analysis by Apartment List, using the latest data from the U.S. Census Bureau, today the median millennial is a homeowner with the rate standing at 51.5%. Millennials are considered people born from 1981-1996.

“For a generation whose identity has been shaped by a tumultuous relationship with the housing market, homeownership has been a lofty goal, growing exceedingly expensive and competitive compared to when their parents were coming of age,” the report said.

Grand Rapids and Minneapolis had the highest percentages of home ownership in major metro areas, while Los Angeles and San Jose had the lowest. The Denver metro sat in the middle, with a little less than half of millennials being homeowners.

Population of an area plays a major factor in whether millennials buy homes, with those living in non-metro areas and places with fewer than one million residents most likely to be millennial homeowners.

The nationwide analysis found that older generations have higher homeownership rates. Generation X (born 1965-1980) is on the cusp of 70% of the generation being homeowners, while 77% of the silent generation (born 1928-1945) still owns their homes — their rate is slowly declining as they age into their 80s and 90s. Baby boomers (born 1946-1964) maintain the nation’s highest homeownership rate today at 78%, the report found.

Apartment List also found that millennials have reached 50% homeownership slower than previous generations. In fact, the last three generation have bought homes slower than the generation that preceded them.

By age 30, 42% of millennials owned their homes, compared to 48% of gen Xers, 51% of baby boomers and nearly 60% of the silent generation. Apartment List pointed to a handful of factors to explain the generational gaps.

“The most significant was the Great Recession, which suppressed homeownership across all generations but was particularly damaging to millennials, whose early career trajectories were shaped by a historically unstable economy,” the report said. “During the economic recovery that followed, many millennials were drawn to centrally-located jobs in cities where starter homes became increasingly scarce and expensive.”

The COVID-19 pandemic drove an even deeper wedge between millennial homeowners and renters. While millennials purchased an outsized share of homes during the first two years of the pandemic, inventory dropped to all-time lows and prices skyrocketed by more than 40%.

“For millennial renters who could not afford to buy a home in the earliest stages of the pandemic, homeownership opportunities waned dramatically in the years that followed,” the report said.

Millennial renters have become more likely to say they will rent forever, the report said, doubling from 13% of the generation saying so in 2010 to 24% in 2022. Nearly three-quarters of those who will rent forever say it is because they expect to never be able to afford homeownership – up from 69% in 2018.

For millennials who plan to buy, 71% say they cannot afford to buy right now, with 58% saying the down payment is one of their biggest obstacles and 42% saying poor credit. The Apartment List survey found that two-thirds of aspiring millennial homebuyers have no dedicated down payment savings and only 15% have more than $10,000 saved.