The city of Longmont conducted a two part housing needs assessment. The first part was released in July and assesses the affordability needs of Longmont and the city’s current inclusionary and incentive policies’ ability to meet those needs.

A generally accepted definition of affordability assumes that households are not burdened by housing costs which assumes that burden is less than 30% of a household’s monthly gross income. Longmont has chosen to identify that number as 33% “as a standard for some of its locally funded housing programs to be more realistic to the local market conditions,” according to the assessment.

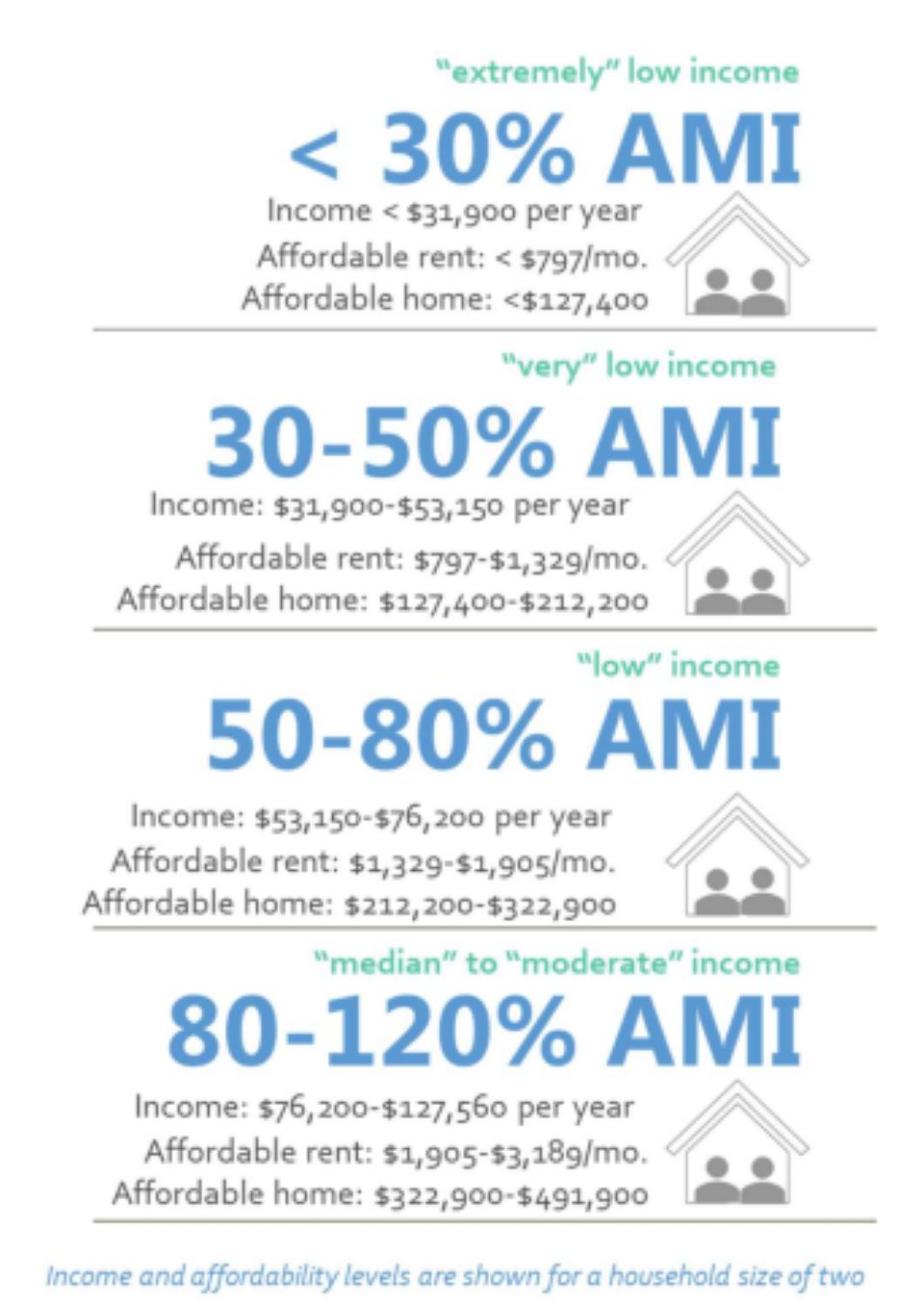

The U.S. Department of Housing and Urban Development, or HUD, determines the current-year income limits based on an internal calculation that estimates area median income, or AMI. These numbers are based on household size and region. Longmont rests in the Boulder County region which all use the same AMI to determine HUD eligibility.

The chart below displays income rates in each of the AMI categories. It also calculates the estimated rent and purchase prices these income levels could afford without being burdened by housing costs.

The actual median income for Longmont in 2021 was $83,104 for an average-sized household of 2.5 people. The HUD AMI for Boulder County in 2021 was $93,000 for a 2-person household and $105,300 for a three person household. Louisville and Broomfield had the highest median income levels at $125,124 and $107,570 respectively.

Longmont rent in 2023 is $1,700 on average and if the rent is considered new construction it can be around $1,950 per month. These rental rates serve households that fall in the 60% to 90% AMI levels. According to the assessment, median renter incomes were able to keep up with the rising rent costs, however, it was difficult to find rental units.

The assessment indicated that there is a 2,173 unit shortage of rentals for households that earn less than 50% AMI.

Only 32% of Longmont’s households can afford to buy a home in the city. The median sales prices of homes in Longmont is roughly $611,421. Buying a home at these prices is only reasonably achievable by households that earn more than 120% AMI, according to the report.

First-time home buyers usually begin as renters first. These home prices are only within reach of 15% of Longmont’s renters, the report states. Only 9% of Longmont homes were listed or sold in 2022 within a price range that fit these budgets.

“Potential buyers do not see proportional affordability in the market unless they have incomes over 120% AMI,” the report states.

Combined this is pushing Longmont’s workforce to seek housing options outside of the city. This makes it difficult for employers to attract workers and for the city to attract new businesses.

The city of Longmont committed to a goal to have 12% of its housing — or 5,400 units — deed-restricted and affordable by 2035. It is currently halfway to this point with 6.66% of total housing stock, or 2,696 units, income restricted.

“In addition to addressing the City’s existing affordability needs, the City should also be prepared to absorb additional housing demand created by both economic and population growth in the City. This will require the addition of both market-rate and affordable housing stock across a variety of product types (e.g., apartments, townhomes, duplexes, single family, etc.) in order to meet market preferences and changing demographics. Demographic shifts toward an older population also signal a need for more accessible/adaptable housing units (or programs) in Longmont,” the report states.