NEWS RELEASE

OFFICE OF ATTORNEY GENERAL

*************************

Attorney General Phil Weiser announced today that his office reached an agreement with third-party debt collection company TrueAccord over illegal collection on high-interest debt. The company will pay $500,000 to the state under the agreement to be used for consumer refunds.

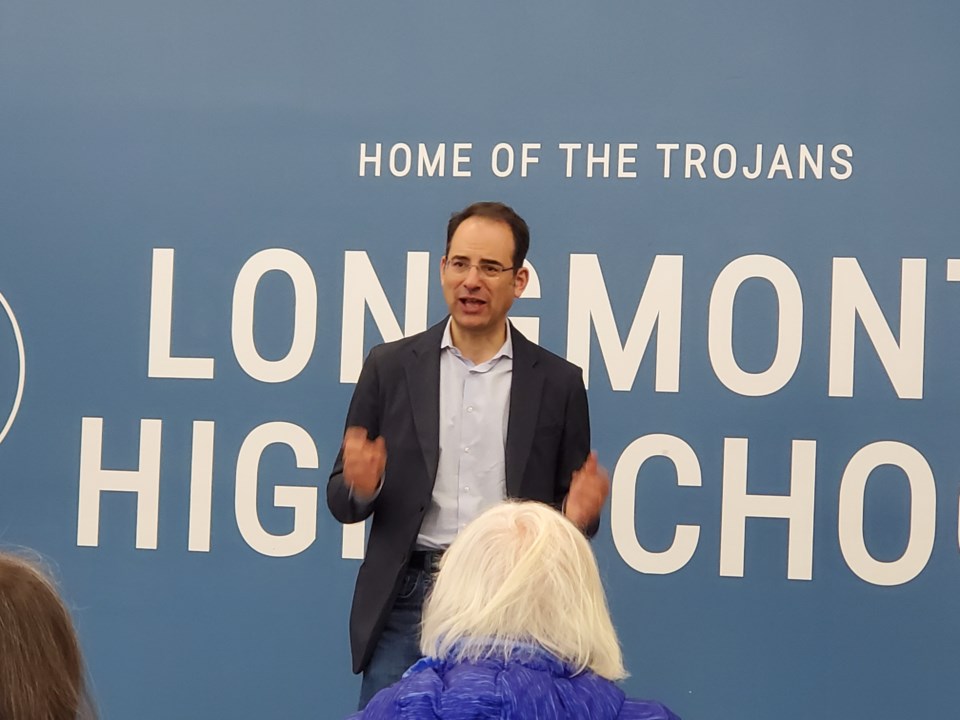

“Colorado consumers are protected from high interest rates on unlicensed loans regardless of where those loans originate,” Weiser said. “My office will hold accountable any companies that violate the law by trying to collect on illegal, high-interest debt. In this action, we are doing just that, and getting money back to consumers in the process.”

State officials routinely monitor lenders, debt collectors, and other consumer credit businesses. In September 2022, investigators with the Department of Law notified TrueAccord that they would initiate an examination of the company’s debt collection practices and then cited the company for violations of the Colorado Fair Debt Collection Practices Act.

According to the settlement, investigators found that, from 2017 to 2022, TrueAccord collected or attempted to collect on roughly 29,000 consumers who defaulted on loans issued by tribal lending entities. These lenders typically operate online and advertise to consumers that their loans are subject to tribal law, rather than Colorado law. Most loans had interest rates over 500 per cent APR, and some approached 900 per cent APR—far greater than the 12 per cent cap for unlicensed loans under Colorado law.

TrueAccord violated state law by telling consumers they owed the full loan balance when they collected or attempted to collect on the debt. For loans made by unlicensed lenders, state law says consumers have no obligation to pay finance charges greater than 12 per cent and it entitles them to refunds if they do pay.

In addition to monetary compensation, TrueAccord will be barred from collecting on any debt where the original loan’s APR exceeded state limits and will provide the state with a list of affected consumers within 30 days. Monetary compensation can be used for any restitution where possible, consumer or creditor education, consumer credit or consumer protection enforcement, or efforts to advance the public welfare.

Consumers who believe they are victims of unfair debt collection can file a complaint with the Colorado attorney general.

*************************